[Market observation] 2023 global composites industry status analysis report 1: (carbon fiber industry)

1.0 Summary

In order to make it easier for people in the industry to understand the status quo of the global composite material industry in recent years, especially in 2022, ZBREHON, as a professional composite material manufacturer, has launched a series of analysis reports on the status quo of the global composite material industry in 2023. This article will briefly summarize the global composite material industry in 2022. Industry status of carbon fiber.

After two years of downturn in 2020 and 2021, the carbon fiber industry rebounded in 2022. In 2022, the global carbon fiber industry’s output will increase by about 9%, and the output value will reach 191 million pounds ($3.6 billion). The dollar value of carbon fiber shipments in 2022 increases by about 27%, as carbon fiber prices increase by about 20% in 2022 compared to 2021.

Before the COVID-19 outbreak, carbon fiber prices were on a downward trend, but this trend was disrupted by geopolitical issues and the outbreak of war between Russia and Ukraine, which led to an increase in the price of natural oil and gas, as well as various raw materials.

Lucintel predicts that the global carbon fiber industry demand will grow at a compound annual growth rate (CAGR) of approximately 7% from 2023 to 2028 due to several reasons, including growth in the use of carbon fiber in wind turbine blades, aircraft deliveries Volume recovery, light vehicle production, sporting goods, and growth in demand for electrical and electronic products.

One of the most noteworthy markets is China, which is currently investing heavily in the carbon fiber market. For example, Sinopec launched China’s first large-scale tow carbon fiber production line with a capacity of 10,000 tons. Companies are innovating and disrupting various end-use industries through the use of carbon fiber. There are hundreds of CFRP parts manufacturing companies in China. Additionally, China is striving to lead the robot and drone market, which will hold great potential for carbon fiber in the future.

![[Market observation] 2023 global composites industry status analysis report 1: (carbon fiber industry)](https://ecdn6.globalso.com/upload/p/240/image_other/2023-10/653f5d62dab7886938.jpg)

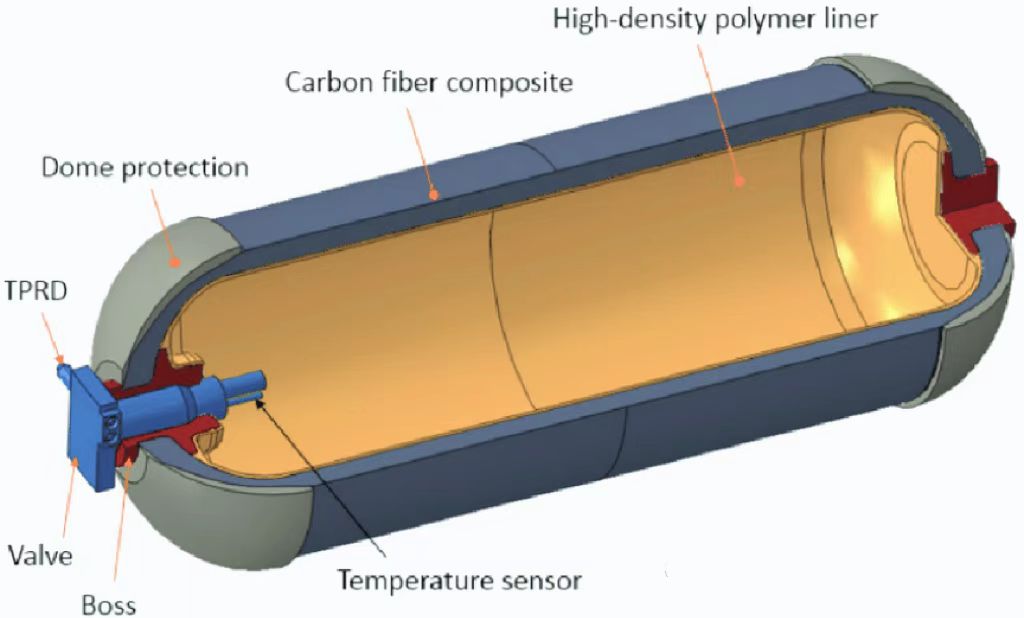

Another trend that will significantly impact the carbon fiber market is the growing interest in the hydrogen economy, with the vision of using hydrogen as a low-carbon energy source. Both hydrogen and electric vehicles are paving the way for cleaner, greener environments on the road. But unlike electric cars, which take a considerable amount of time to recharge, hydrogen cars can be refueled quickly from gas stations. Hydrogen fuel cells can also be used to power passenger cars, heavy trucks, buses, forklifts, airplanes and other transportation vehicles.

Due to the lack of a strong hydrogen infrastructure, global demand for fuel cell vehicles will only account for 0.03% of total vehicle sales in 2022. In addition, consumers around the world do not have many options for hydrogen fuel cell vehicles. The good news is that the demand for fuel cell vehicles has grown rapidly in recent years. If this trend continues, demand for carbon fiber will grow rapidly as it is used in fuel cells, electrolyzers and hydrogen storage tanks.

Circular economy trends focusing on the reuse and regeneration of materials and products will also influence the growth of carbon fiber in the future. In terms of sustainability, carbon fiber components allow for significant weight savings, which in turn reduces fuel consumption and greenhouse gas emissions. But recycling carbon fiber components at the end of their life is a challenge. Lucintel’s research points to many cases where carbon fiber is recycled from process waste, but is not currently recycled at end-of-life.

Material suppliers and component manufacturers are under increasing pressure to engage in sustainable practices that support a circular economy. Whether it’s automotive, wind energy or aerospace OEMs want to hear good circular economy stories about carbon fiber and carbon fiber components.

Most OEMs aim to be carbon neutral between 2030 and 2050, and they are already considering recycling as part of their design criteria for next-generation part manufacturing. By utilizing innovative technologies and materials, material and component suppliers that enable OEMs to achieve circular economy goals will gain market share in the future.

Reference source: https://mp.weixin.qq.com/s/ZPNhsJbaxSIFZgbbwOIWmg

The one-stop lightweight solution service provider around you. Choose ZBREHON, choose Leading.

Website: https://www.zbrehoncf.com/

E-mail: Email: sales2@zbrehon.cn

Tele:+86 13397713639 +86 18577797991

![[Market observation] 2023 global composites industry status analysis report 1: (carbon fiber industry)](https://ecdn6.globalso.com/upload/p/240/image_product/2023-11/655341c3a2c6b35751.jpg)